Back to Base

By strengthening their brands and expertise in the domestic market, export-oriented companies can enhance both their added value and their resilience, which are key for regaining a strong presence on the global stage.

Chinese consumers browsing e-commerce platforms or walking in supermarket aisles have noticed a new feature: dedicated sections for high-quality export products.

Far from being a mere marketing gimmick, this trend emerged due to intense pressure from a slide in global demand. As the US announced to raise tariffs on Chinese goods in April (which were later substantially eased after meetings between the two sides in mid-May), export-focused companies faced unprecedented uncertainty. To cushion the impact and assist their transition from relying solely on exports to tapping the domestic market for sales, several local governments, often in partnership with digital platforms, rolled out a range of initiatives.

The goal of these initiatives is to help export-focused companies to gain a foothold in the domestic market by organising networking events, issuing supportive policies, and enhancing business services. This strategic shift is full of potential.

Timely support

Silver Phoenix, a ceramics manufacturer with over 60 years of history, 40 percent of whose revenue came from the US market, was hit hard by the hike in tariffs.

“It was the first time I faced the situation of goods worth several million dollars being stuck in a warehouse,” said Zhang Bin, the company’s sales manager with over 30 years of export experience. Just as Zhang was about to lose hope, a call from JD.com changed everything. Within 24 hours, a platform representative was on-site, helping him to launch an online store.

Silver Phoenix is far from alone. Under the guidance of China’s Ministry of Commerce (MOFCOM), several digital giants have introduced support measures to help redirect goods for exports towards the domestic market. JD.com, for example, pledged to purchase at least 200 billion yuan ($28 billion) worth of goods over a 12-month period. As a result, many companies that previously relied entirely on international markets are now discovering the vast potential of domestic consumption.

To better cater to local demand, Silver Phoenix assembled a dedicated e-commerce team to study consumer trends and develop “surprise boxes” aimed at younger buyers. Today, Zhang is active on more than 10 platforms and has already received orders for customised products from about 30 Chinese clients.

According to MOFCOM, 15 major platforms have introduced eight types of support measures including direct procurement, supplier-buyer meetings, and logistics assistance. These efforts have connected over 20,000 export manufacturers to new domestic customers, with around 2,600 companies setting up online stores. These initiatives have resulted in cumulative sales of over 600 million yuan ($83 million) as of early May.

Brick-and-mortar retail has also followed in the footsteps of e-commerce giants. On 7 April, Yonghui Superstores announced a “green channel” for export-dependent businesses, offering fast-track shelving, marketing campaigns, and co-development of products, a move welcomed with enthusiasm.

One of the first to respond was Mu Longsheng, head of a toothbrush and dental floss manufacturing firm that traditionally supplied to Walmart. With 80 percent of his business geared towards overseas markets, the drop in US orders was drastic. That very day, he contacted Yonghui. A week later, a preliminary agreement was signed, and the company is now discussing producing under the retailer’s own brand.

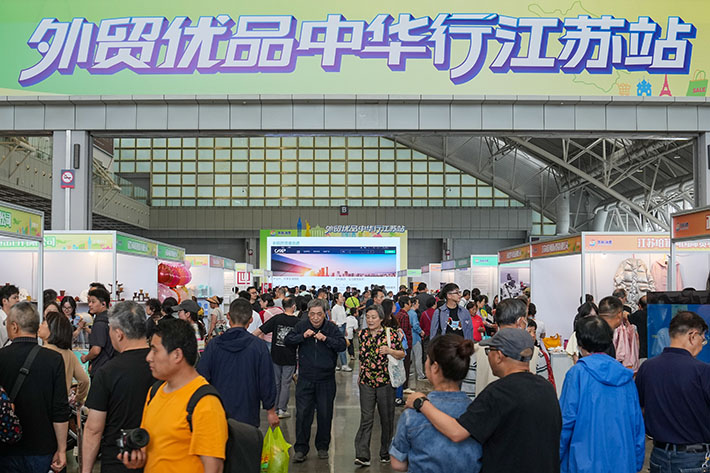

On 13 April, at the 5th China International Consumer Products Expo in Haikou, Hainan Province in south China, MOFCOM launched the Premium Foreign Trade Goods China Tour. Targeting 10 strategically important provinces, this initiative aims to better integrate domestic and international trade, with a focus on everyday consumer goods. During an exhibition of the tour in Nanjing, east China’s Jiangsu Province, Nantong Shield Bags, which has been active in the US, European, and Japanese markets since 1998, sold almost its entire catalogue of 400 products within hours. Major platforms like JD.com, Taobao and Tmall Group, and Freshippo quickly expressed interest in partnerships. By 2 May, 10 regions, including Shanghai, Sichuan, and Jiangsu, had hosted similar expos. Initial data shows that more than 2,400 export firms and 6,500 buyers attended the expo, generating intended purchase agreements worth 16.76 billion yuan ($2.3 billion).

Eye on the future

While this shift towards the domestic market was initially driven by urgency, businesses now consider it as a long-term strategy. According to the National Bureau of Statistics, China recorded a total of 48.78 trillion yuan ($6.73 trillion) in retail sales of consumer goods in 2024, an increase of 3.5 percent compared to the previous year. This trend highlights the strength of domestic purchasing power and provides a fertile ground for export-oriented companies seeking to realign their business models. According to a report in People’s Daily, nearly 85 percent of the hundreds of thousands of export-focused companies are now selling in the domestic market as well, which already accounts for 75 percent of their overall revenue. These companies are expanding their domestic footprint, investing in brand building, and laying the groundwork for sustainable growth. A quiet yet profound transformation is underway.

The road ahead, however, is riddled with obstacles. The first major challenge is a lack of brand recognition. For a long time, export-oriented companies used an order-based model, paying little attention to how they were perceived by end consumers. Zhang Jing, general manager of Sichuan Qianpinen Trading, illustrated: “Our breads and cookies sell well in Europe and North America, but in China, our brand is virtually unknown.” To boost visibility, she decided to partner with Hongqi Chain, banking on its physical supermarket network to reach domestic consumers quickly.

Another major transformation lies in the change in the order model. Transitioning from large bulk orders to numerous small ones requires a complete overhaul of the supply chain. Mass production on automated lines is no longer viable – companies must now readjust production lines, reintroduce manual labour, and shorten lead times. “We have to prepare for an era of frequent small orders. Eventually, online sales will be the only way to clear inventory,” predicted Teng Buxiang, head of Zhongxin Environmental Protection Technology. This shift is prompting many companies to adopt a hybrid model: a centralised production unit combined with a dedicated team for managing digital platforms.

Added to these challenges is the difference between domestic and international standards. In the textile sector, for instance, European and American standards are often more stringent than those in China. “Companies that wish to maintain a presence in both markets must adapt their production lines accordingly, which increases costs,” said Cheng Weixiong, a textile industry expert. To address this issue, MOFCOM has launched an initiative aimed at narrowing the gap between Chinese and foreign standards, conducting comparative studies and promoting certification harmonisation. Ultimately, successfully navigating this transition requires three types of shifts – from subcontracting to original design, from competitive pricing to focus on quality, and from dependence on platforms to a clear brand strategy. According to experts, this shift is in no way at odds with China’s economic openness; in fact, it is in sync with the “dual circulation” model – a policy framework designed to strengthen the interplay between domestic demand and international trade. On 25 April, the Political Bureau of the Communist Party of China Central Committee reaffirmed this commitment: “We must remain firmly determined to manage our own affairs well and to continue pursuing high-level openness.”

By strengthening their brands and expertise in the domestic market, export-oriented companies can enhance both their added value and their resilience, which are key for regaining a strong presence on the global stage.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +