The 90-Day Countdown

With the news of the tariff rollback came what many in the industry have referred to as a 90-day ‘golden window’—a narrow but decisive period in which foreign trade companies can rush to fulfill delayed demand and increase inventory.

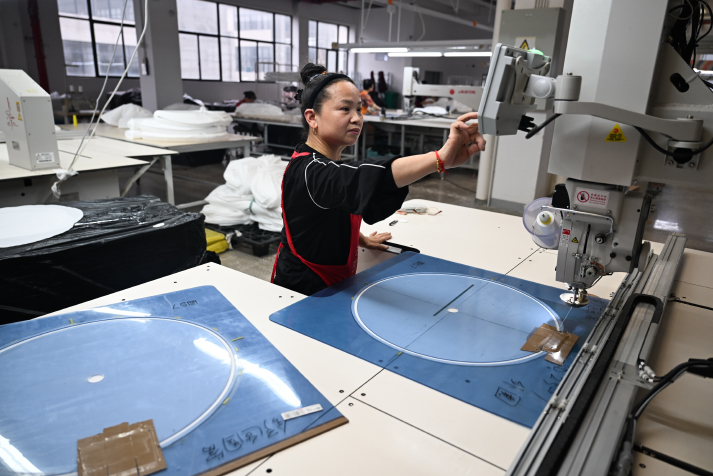

Shanghai Wareda Sunshade Equipment Co. Ltd. built its business on a niche but thriving export—recreational vehicle awnings favored by American buyers. The U.S. market had therefore long been a major source of profit for the company, but after U.S. President Donald Trump imposed new tariffs on imports from China in early April, customers pulled back—and exports plummeted.

“Production stopped. Inventory piled up. The pressure on our cash flow was suffocating,” the company’s founder Ding Linfeng recalled. The business, once steady and optimistic, was suddenly paralyzed.

At a moment when exporters were still reeling and unsure of what lay ahead, a joint statement from the China-U.S. trade talks in Geneva, Switzerland, was released on May 12. It outlined a series of tariff modification measures aimed at easing trade tensions between the world’s two largest economies.

Effective May 14, the U.S. suspended 24 percentage points of its 34-percent “reciprocal tariff” imposed on Chinese goods on April 2 for an initial period of 90 days—retaining a 10-percent baseline. In parallel, China has implemented an adjustment accordingly by suspending 24 percentage points of that rate for an initial period of 90 days, while also retaining a 10-percent baseline.

The U.S. has also removed 91-percent additional tariffs put in place following China’s countermeasures against the “reciprocal tariff,” while China has responded with canceling its additional tariffs of 91 percent.

Within hours in the wake of the announcement, Ding’s phone began ringing and didn’t stop. American clients rushed to re-engage. One placed an immediate order worth $100,000. Another went one step further, indicating plans to purchase two full containers’ worth of product.

With the news of the tariff rollback came what many in the industry have referred to as a 90-day “golden window”—a narrow but decisive period in which foreign trade companies can rush to fulfill delayed demand and increase inventory. For business owners like Ding, it’s a race against time.

A 90-day window

Wu Qingfen, owner of Yiwu Jingwen Import and Export Co. Ltd. in Zhejiang Province, checked her phone the morning after the announcement and was stunned to see a fresh order for 300,000 pairs of socks. The news was so unexpected, she was nearly moved to tears. Just one day earlier, she had been calculating her factory’s financial losses.

In Shenzhen, Guangdong Province, Wang Li, General Manager of Maiqijia Home Furnishings Co. Ltd., had been on the verge of abandoning the U.S. market entirely. Then, in just one day’s time, she received four separate orders totaling $300,000.

The recovery was not limited to new orders alone. Clients began urging immediate shipment, reviving previously delayed orders that had been shelved due to tariff concerns. Many now requested air freight or early delivery.

“This kind of demand was almost unimaginable before,” Wang told news portal Jiemian.com.

In response, Wu quickly resumed production. More than 200 sock-knitting machines were restarted and her team began working around the clock to fulfill the massive order, which is expected to keep the factory busy until late June. Wang, on the other hand, was coordinating the shipment of eight containers to the U.S. within a single week.

In Dongguan, a major foreign trade hub in Guangdong, Zheng Xingzhong of Guanrui Furniture Co. Ltd. immediately instructed his staff to contact customers and book shipping slots following the tariff reduction. The response from clients was swift and highly encouraging.

For many small and medium-sized exporters, these sudden developments were a turning point. What once seemed like a prolonged downturn has now shifted into a moment of cautious optimism, as international demand begins to show clear signs of revival.

American retailers and manufacturers also rushed to place orders with Chinese suppliers.

Jay Foreman, chief executive of Florida-based toy maker Basic Fun, was jolted awake at 4 a.m. (local time) by the tariff rollback announcement. Without hesitation, he got to work. “We’re mobilizing everything,” he said in an interview with The New York Times. “We’re on the phone with trucking partners in China, lining up factory pickups, and are scrambling to secure container space on outbound vessels.”

U.S. retail giants like Walmart and Target, which had scaled back orders or paused procurement from Chinese manufacturers amid tariff-related uncertainty, have also rushed to restore supply lines.

The urgency is especially high as companies gear up for the all-important holiday sales season.

The short-term nature of the tariff reduction agreement has created a logistical sprint. With the 90-day tariff suspension acting as a hard deadline, companies are forced to make swift, high-stakes decisions about inventory and shipping. Given ocean freight from China to the U.S. West Coast takes two to three weeks, goods must be en route by late July to arrive before the 90-day window closes.

According to a report by China Central Television (CCTV) on May 14, data released by trade tracking firm Vizion demonstrated a dramatic spike in container bookings from China to the U.S. following the mutual tariff reductions.

As of May 5, the seven-day average for U.S.-bound container bookings from China stood at 5,709 TEUs (twenty-foot equivalent units, a base measurement in the shipping industry). By May 14, that figure had soared by 277 percent.

However, this sharp rebound in demand has collided with limited shipping capacity, creating immediate pressure on freight rates. According to recent projections from U.S.-based maritime analytics firm Xeneta, shipping costs from China to the U.S. West Coast are expected to rise by 20 percent in the coming weeks. The surge in rates is yet another complication layered on top of an already narrow trading window.

Eggs in different baskets

Chervon Group headquartered in Nanjing, Jiangsu Province, has established itself as a leading force in the U.S. lawn care market, with its lawn mowers consistently ranking among top sellers. The American market accounts for a 70 percent of the company’s total business. Thanks to its warehouses in the U.S., Chervon was able to maintain a steady delivery of products to local retailers, even during periods when the broader industry came grinding to a halt.

With trade tensions easing, company executive Zhou Xiaoyun has been working around the clock, holding back-to-back video conferences with key U.S. clients. Discussions have focused on optimizing logistics strategies, prioritizing order fulfillment and ensuring alignment on delivery schedules to make the most of the limited tariff window.

Still, Zhou remains cautious. “While the outcome of the negotiations offers a more positive outlook, uncertainty in China-U.S. trade relations remains,” she told Nanjing-based newspaper Xinhua Daily. The company has come to terms with the risks of overreliance on a single market. In response, Chervon is moving ahead with plans to expand its manufacturing footprint in Vietnam.

“We can’t afford to put all our eggs in one basket,” Liu Dongliang, General Manager of a textile import-export company based in Xiamen, Fujian Province, told CCTV. The company is actively expanding into other regions beyond the U.S.

Domestically, Liu sees growing opportunity. “We’re launching our own domestic consumer brand later this year,” he said. “We’ll be rolling it out across all major e-commerce platforms. Diversifying is no longer a choice—it’s a necessity.”

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +