Policy Expectations of the “Two Sessions”

Structural reforms will be the key point of observation in the coming annual sessions of the National People’s Congress and the National Committee of the Chinese People’s Political Consultative Conference (CPPCC), often called the “two sessions” in China.

By Sumantra Maitra

Structural reforms will be the key point of observation in the coming annual sessions of the National People’s Congress and the National Committee of the Chinese People’s Political Consultative Conference (CPPCC), often called the “two sessions” in China.

The Chinese economy will face two primary challenges, which will be the key to understand the trajectory of China as a great power. It also marks the 40th anniversary of the country’s reform and opening-up policy. Firstly, the domestic challenges are related to taming macroeconomic impulses, while formulating structural reform policies. The external challenges involve calculating the impact of foreign influence on domestic policies. China is trying to achieve a phase of rapid growth, commensurate with the plan of President Xi to be a moderately affluent nation by 2021.

Consider the foreign influences first. The market needs to play a determining role in the allocation of resources and private property. Last year, China pledged to open up and align itself with global rules of trade and to further invite investment. The development of the domestic market is also a huge factor serving as a guarantee against market collapse. A growing domestic market is of utmost importance as China will become the world’s largest market, with a market size that is potentially three to four times that of the U.S. The Chinese market is a prime target for reciprocating trade deals with the EU and Britain by promoting cooperation.

More importantly, however, a tax cut by the Trump administration has led to concerns that investment flows will favor the United States. A weakening dollar would add to that. It would set a round of major tax cuts in other economies. Europeans are reticent about this new trade war, and they are the key in the upcoming financial scenarios.

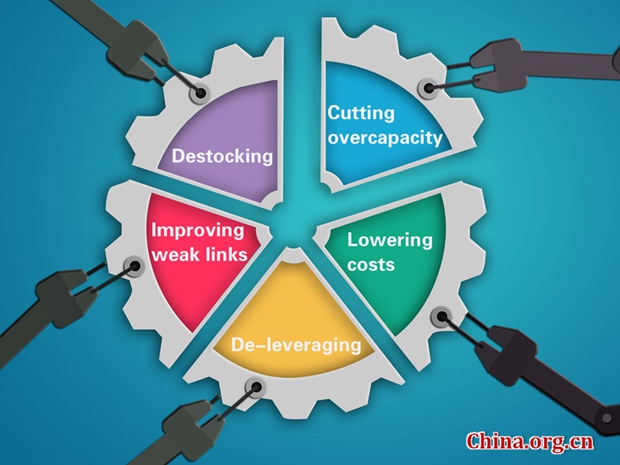

Under these changing global circumstances China has no choice but to speed up reforms and commit to opening up. The key would be to advance supply side structural reforms. The structural mismatch needs to be tackled with a buildup of domestic demand. The housing sector, public infrastructure, and institutions need further adjustment. Liu He’s speech at the world economic forum also highlighted three key battles which will need to be worked upon in the two sessions.

The three sectors mentioned were: 1) preventing and resolving major risks, 2) conducting targeted poverty reduction, and 3) controlling pollution.

As for pollution, a commitment to climate change is another plank. It is precisely important because if China needs to maintain and keep the EU on its side, it will need to be an ally of Europe in areas of climate change and take up a leadership position. Recently there were momentous steps taken to tackle climate change in world’s second largest economy.

There were soldiers on tree planting duties, billions of renminbi spent on clean energy and a rapid move away from coal. The EU is taking this opportunity to push China to a leadership position with regards to climate. As President Macron said in a speech during Chinese New Year, “From the signing of the Paris Agreement to the confirmation of her involvement, it is a radically new and profoundly structuring choice that has been made by our Chinese ally on this subject.”

The features which are the pathways to that goal is to minimize major financial risks, reduce poverty, avoid the middle-income trap in the cities. Designing key structural policies therefore remain imperative.

Source: China.org

Sumantra Maitra is a columnist with China.org.cn.

Opinion articles reflect the views of their authors only, not necessarily those of cnfocus.com

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +