Flee or Flock?

Foreign investors are not fleeing China but will keep flocking to the country as it remains a destination more than worthy of their assets.

“Foreign capital withdraws from China,” “Vietnam to replace China as the world’s workshop… ” Headlines like these are gaining much attention in the West. Citing the Chinese economic slowdown in the first half of this year amid COVID-19-induced lockdowns, the “China collapse” rhetoric is on the rise, again.

However, a report issued by the Third Qingdao Multinationals Summit, co-sponsored by the Ministry of Commerce and Shandong Provincial Government, held from June 19 to 21 in Qingdao, shows that China remains an important investment destination for transnationals. These companies are steadily increasing their input in China and optimizing the mix, with operating profits going up.

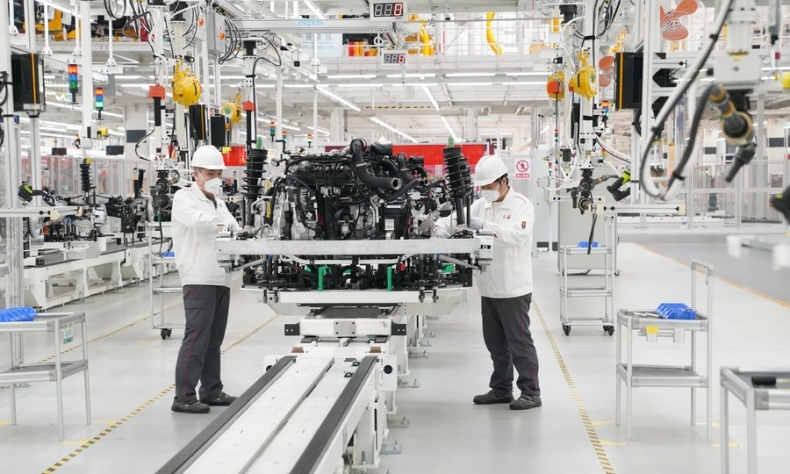

Although the global supply chain is currently undergoing a new round of restructuring, China still occupies a powerful position. As the biggest manufacturer in the world, the country boasts large-scale and well-developed supportive facilities for the sector, rendering its supply chain’s resilience virtually undisputable. Despite the low-cost advantage today being less obvious than before, China’s other qualities like high productivity and digitalization are emerging.

According to the report, China’s huge market potential and rising status in Asian supply chains denote an ever-expanding space for development. Compared with other developing countries, China is producing more innovation and boasts a higher research and development conversion ratio. The country is further aligning itself with international economic and trade rules, promoting its international cooperation and competitiveness. All of these reinforce China’s advantage in the global supply chain.

China’s absorption of foreign capital keeps growing as the many attractive factors remain in place. In 2021, China received a total of 1.15 trillion yuan ($171.8 billion) in foreign investment, up 14.9 percent year on year. In the first four months of 2022, the amount hit 478.6 billion yuan ($71.5 billion), up 20.5 percent year on year.

Though many multinationals have been battered by the pandemic since 2020, the influx of foreign capital in 2021 best reflects their confidence in the Chinese economy and its brighter prospects.

At pace with the upgrading of China’s manufacturing sector, their investments are moving from low-end processing manufacturing toward hi-tech manufacturing, and from low value-added to high value-added products. Hi-tech manufacturing accounts for one third of foreign investment, while production in labor- and energy-intensive, as well as high-polluting, industries now sees a decline in such investment.

Recent years have witnessed more big projects receive foreign investment. New contracts with foreign investments worth over $100 million jumped from 834 in 2019 to 1,177 in 2021.

The report also pointed out that the operating earnings of multinationals have continued to grow; this is another reason why they are ready to up their investment in China. In the past decades, a growing number of multinationals investing in China achieved their own development while lifting both China’s economic growth and globalization. Despite the complex international environment right now, the long-term upbeat momentum of the Chinese economy endures.

As the document indicated, China will further expand its market access, promote fair competition and provide a more liberal and convenient environment for trade and investment.

Thanks to effective and simultaneous pandemic control and economic growth measures, the country’s major national economic indexes for May saw improvement and the second half of the year is expected to see sound growth. This stable pace has reinforced global confidence in China’s economic prospects. According to the latest white paper issued by the American Chamber of Commerce in China, many of its members believe that to win in the arena of global competition, one must maintain competitiveness in the Chinese market. And so they have no intention of taking their business elsewhere.

China’s appeal to multinationals and the huge profits they have turned in the country outweigh claims that the Chinese economy is about to collapse. Foreign investors are not fleeing China but will keep flocking to the country as it remains a destination more than worthy of their assets.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +