Libra and World Vigilance

Libra seems to build a new entry for global users into an era of digital finance.

Libra, as a digital currency, has a symbiotic relationship with traditional currency, meaning that the value of Libra strictly corresponds to Fiat reserves. If you want to own new Libra, you have to purchase it according to the Fiat-to-Libra ratio of 1:1 and turn such Fiat into reserve. If you want to reconvert Libra to Fiat, you must write it off. That is to say, Libra carries on the core function of Fiat, creating debts, thus avoiding the volatility of traditional digital currencies.

What are the Advantages of Libra?

First, it simplifies payments. On the one hand, it can reuse the current Internet infrastructure because it is not subject to traditional account systems and private networks. On the other hand, it will become a relative stable payment instrument for those countries whose currency value is fluctuating. In other words, Libra will force countries implementing foreign exchange control to open up further. In this sense, it will encourage more people to enter the market, thus enhancing the global productivity.

Second, it makes contracts smart. Nowadays, supervising contract performance needs a lot of social resources. For example, A and B enter into a purchase agreement. In the event that A fails to fulfil its payment obligations, B has to take actions such as going to court, filing a lawsuit, and providing evidence. During the whole process, B has to consume a large amount of human and material resources, and the society has to bear great friction costs. But for a smart contract, its articles are a string of codes written in Blockchain. That means such codes will be executed automatically and independent of human will once any term and condition hereof is triggered.

Second, it makes contracts smart. Nowadays, supervising contract performance needs a lot of social resources. For example, A and B enter into a purchase agreement. In the event that A fails to fulfil its payment obligations, B has to take actions such as going to court, filing a lawsuit, and providing evidence. During the whole process, B has to consume a large amount of human and material resources, and the society has to bear great friction costs. But for a smart contract, its articles are a string of codes written in Blockchain. That means such codes will be executed automatically and independent of human will once any term and condition hereof is triggered.

Libra seems to build a new entry for global users into an era of digital finance. However, this road ahead still faces problems such as legitimacy, supervision, people’s concepts, and rebounds in the financial systems.

What are the Positions of IMF and National Governments on Libra?

IMF’s attitude to Libra depends on whether it impacts the normal operation of the existing international monetary system. Currently, IMF has paid special attention to its anti-money laundering and countering the financing of terrorism. Ross Leckow, co-head of IMF’s Financial Technology Working Group (FinTech), stated that cryptocurrencies are superior to any other intermediary agents in peer-to-peer transactions because of their anonymity. He also said that they were also easily used for criminal purposes, for example, stealing private money, laundering money, evading legal sanctions, and purchasing tools.

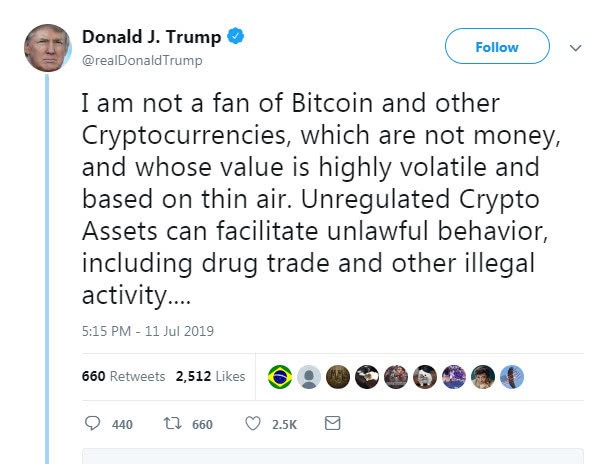

On July 12th, U.S. President Donald Trump criticized Libra and other digital currencies, and asked their companies to abide by corresponding banking regulations. That is practically because Libra may threaten the power of the U.S. government as the authority of currency credit to issue bonds and release loans, change its current currency transaction system, and impact the U.S. currency system. Facebook has about 3 billion users and its Libra is based on blockchain technology, thus significantly saving exchange transaction costs and having huge impacts on interests. Jerome Powell, Chair of the Federal Reserve, said to senators that Libra, a digital currency created by Facebook, couldn’t go far unless it could eliminate worries such as privacy disclosure, money laundering, consumer protection, and financial stability.

On July 12th, U.S. President Donald Trump criticized Libra and other digital currencies, and asked their companies to abide by corresponding banking regulations. That is practically because Libra may threaten the power of the U.S. government as the authority of currency credit to issue bonds and release loans, change its current currency transaction system, and impact the U.S. currency system. Facebook has about 3 billion users and its Libra is based on blockchain technology, thus significantly saving exchange transaction costs and having huge impacts on interests. Jerome Powell, Chair of the Federal Reserve, said to senators that Libra, a digital currency created by Facebook, couldn’t go far unless it could eliminate worries such as privacy disclosure, money laundering, consumer protection, and financial stability.

He also said that the Federal Reserve had set up a working group and was coordinating with the central banks of other countries. It is expected that the Financial Stability Oversight Council of the United States, consisting of regulatory bodies and responsible for identifying risks to financial systems, will also carry out an assessment on Libra.

People’s Bank of China announced on June 22, 2019 that the so-called “digital money” in China is illegal.

Wang Yongli, former vice governor of the Bank of China, holds a negative attitude towards Libra. He argued that although the practice of large financial institutions or professional organizations to improve their payment and settlement systems by using technologies such as blockchain is worth encouraging, it remains unrealistic to replace a country’s national currency or legal tender with an online digital currency. He added that no matter how its specific design changes, any “stable digital currency” fully grounded and anchored on legal tender can only be a kind of token money operating on certain online platforms, which can never replace or disrupt the status of legal tenders.

Mu Changchun, deputy director of the payment division of the People’s Bank of China, shows a relatively neutral attitude towards Libra. He believes that as a kind of convertible cryptocurrency or stable currency, Libra can circulate freely across borders only when it operates under the joint support and supervision from central banks of various countries. However, from a long-term perspective, if Libra can achieve free exchange with the RMB, this will enable China to address certain foreign exchange risks.

Indian Economic Affairs Secretary Subhash Garg absolutely opposes Libra. He argued that Facebook has yet to fully explain the design mechanism of this digital currency. India doesn’t accept Libra as a private cryptocurrency. The Indian government and India’s central bank have actually announced that cryptocurrencies are illegal by banning banks from engaging in cryptocurrency transactions. The Reserve Bank of India has taken restrictive measures on cryptocurrency transactions. Moreover, the Indian government is drafting a bill to impose strict punitive measures on those using cryptocurrencies.

Indian Economic Affairs Secretary Subhash Garg absolutely opposes Libra. He argued that Facebook has yet to fully explain the design mechanism of this digital currency. India doesn’t accept Libra as a private cryptocurrency. The Indian government and India’s central bank have actually announced that cryptocurrencies are illegal by banning banks from engaging in cryptocurrency transactions. The Reserve Bank of India has taken restrictive measures on cryptocurrency transactions. Moreover, the Indian government is drafting a bill to impose strict punitive measures on those using cryptocurrencies.

According to the Reuters, the UK, French and German central banks have all planned to strengthen supervision on Libra to ensure it will not threaten their financial systems or be used for money laundering. Mark Carney, governor of the Bank of England, said that Libra must be secure, and that the Bank of England, the U.S. Federal Reserve, as well as central banks and banking regulators of all major countries in the world, should directly supervise the operation of Libra. Francois Villeroy De Galhau, governor of France’s central bank, declared that France will form a stable currency special workforce under the framework of G7 to conduct supervision on digital cryptocurrencies including Libra. Meanwhile, UBS noted that without proper supervision it cannot allow Facebook to operate a new kind of cryptocurrency in UBS bank accounts.

Darren Soto, a U.S. congressman and co-chairman of the Congressional Blockchain Caucus, is relatively optimistic about the future of Libra. He believes that Libra represents a major step towards a financial infrastructure that is more globalized and inclusive, thus enabling more people to access mobile and digital payment methods. This will eventually benefit our society and become a new driver for economic growth, he added.

The legal tenders of many countries around the world are facing the challenges posed by Libra, especially countries in the Global South (including Africa, Latin American, and most parts of Asia). Countries with underdeveloped financial infrastructure and weak regulatory systems, such as Zimbabwe, are more vulnerable to the impact of Libra. Once it becomes an integral part of the social structure of those countries, Libra will demonstrate power like a centralized currency. Considering that digital currency is out of the control of the governments of those countries, it will pose a threat to their national security.

The legal tenders of many countries around the world are facing the challenges posed by Libra, especially countries in the Global South (including Africa, Latin American, and most parts of Asia). Countries with underdeveloped financial infrastructure and weak regulatory systems, such as Zimbabwe, are more vulnerable to the impact of Libra. Once it becomes an integral part of the social structure of those countries, Libra will demonstrate power like a centralized currency. Considering that digital currency is out of the control of the governments of those countries, it will pose a threat to their national security.

Maxine Waters, head of the U.S. House Financial Services Committee, said that “given the company’s troubled past,” she asked Facebook to “suspend development of the cryptocurrency until the U.S. Congress and regulatory authorities have chances to review relevant issues and take action.” The U.S. House Financial Services Committee will hold a hearing on July 17. Let’s wait and see what decision the U.S. government will make regarding Libra.

Li Dongxin, vice director of the Center for Northeast Asia Research under the Academy of International Affairs, Shandong University.

Editor: Dong Lingyi

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +