The Trade War Threat Starts with American “Civil War”

The US government has been mired in chaos since Donald Trump came into power. It seems that the United States is preparing to launch a “civil war” rather than a trade war.

The US government has been mired in chaos since Donald Trump came into power.

A Huge Power Struggle

In little more than a year many of his spin doctors and cabinet officials have resigned, suggesting that his administration’s political base is seriously unstable. Behind the chaos is relentless competition among major interest groups represented by the Republican Party.

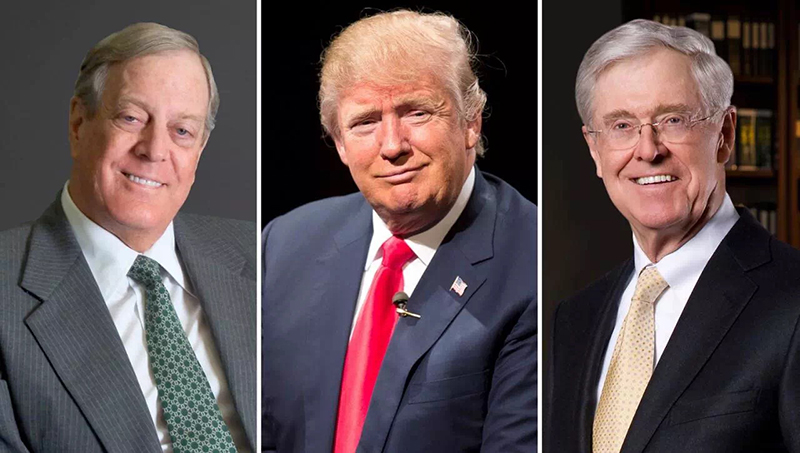

Looking back at the 2016 US election, Trump won the Republican Party’s primary election, a result which was not welcomed by mainstream Republican forces. However. the groups behind the Republican Party, especially those industry groups led by the Koch brothers, still reached a tacit understanding with Trump administration to take Mike Pence – now vice president – on as running mate for the overall interests of the party. Trump’s former Chief Strategist Steve Bannon described the deal as “a Faustian Bargain”.

The political transaction led directly to a huge power struggle. Every faction was trying to take control of the White House. In June and July of 2017, the struggle between different forces resulted in a huge shake-up. Now an even bigger change at the top of government is ongoing, marked by the firing of Secretary of State Rex Tillerson, the resignation of the president’s economic adviser Gary Cohn, and the replacement of the national security advisor H.R. McMaster. It is expected that in the first half of this year, the occupants of the key roles of White House Chief of Staff and Minister of Justice will be replaced.

The new round of personnel turnover signals an escalating dispute within the US Republican Party. It is forecast that the Trump administration might achieve relative stability by the second half of this year.

A “Civil War” Rather Than a Trade War

The current imbroglio has allowed some “hawks” to come forward in pursuit of benefit and to further the interests of the groups they represent.

▲Peter Navarro, a well-known trade hawk, is a good example. He does not speak for the mainstream opinion of the Republican Party in the United States. He stands for a very small part of the United States’ domestic industry. Regarding tariffs issues on imported steel and aluminum, Navarro speaks for a small part of the steel and aluminum producing companies, but not the interests of the larger manufacturers. Therefore, I see Navarro more as Trump’s “attack dog” than a serious policy advisor that he can use in the long term.

It would appear that the United States is preparing to launch a “civil war” rather than a trade war.

Trump’s Tariff Plan Stir Up Opposition

One strange thing about the issue of tariffs on steel and aluminum is that the main voices in support of Trump came from the “ultra-leftists” within the Democratic Party, while the Republican mainstream maintained its distance.

For instance, Paul Ryan, Speaker of the House of Representatives, put forward a clear objection to Trump’s plan, and more than 100 members of the House of Representatives also opposed it in the form of an open letter.

With the fundamental interests of many countries involved, it goes without saying that Canada, Mexico, the European Union and other economies have strongly opposed the plan. The European Union has already proposed clear countermeasures. The pressure on Trump’s tariffs is enormous.

In terms of foreign policy, President Trump always speaks aggressively but acts modestly. No one believes there will be any winner in a trade war, and I think that Trump must also understand that. Issuing threats of trade war draws everyone into a game of “chicken”. Whether Trump persists with his mistake is dependent on the determination, will and negotiating skills of the other parties.

There is no doubt that, to a large extent, Trump is using the tariff threat as leverage in pursuit of more advantageous terms with his trading partners. However, I doubt that any country will easily submit on matters concerning its fundamental interests.

301 Investigation Causes a Plunge in US Stock Market

The volume of trade between China and the United States is so enormous that any bilateral trade conflict will affect the world economic recovery. Undoubtedly, there is a huge trade imbalance between China and the US. But this is absolutely not the result of a deliberate effort by the Chinese side. It is determined by a series of factors including the American labor force structure, the economic structure, and the US dollar, which serves as the world’s reserve currency.

If the United States wants to resolve the trade imbalance, it must implement vigorous reform measures on the supply side to increase its ability to supply cost-effective products rather than trying to limit the supply capacity of other countries.

▲At noon on March 22 Trump signed a presidential memorandum calling for a 301 investigation and requested the US Trade Representative to impose sanctions on China, risking a trade war. Leaving aside the lack of substance in the accusations against China in this memorandum, the panic it caused in the Wall Street in the United States is enough to prove that US companies and stock market investors would be the biggest victims of a trade war initiated by the Trump administration.

▲On the afternoon of the 22nd, the US stock market plunged across the board. The Dow Jones index constituent stocks, representing the most powerful companies in the United States, were not immune. For Trump, who has repeatedly claimed that he will reinvigorate the US manufacturing industry, the most ironic fact is that two of the highest fallers were Caterpillar and Boeing, two leading US manufacturing companies.

What will China Do?

Personally I believe that the trade imbalance between China and the United States can be alleviated in the medium to long term. We have already seen some very positive signs. For example, oil and natural gas exports from the United States to China are increasing substantially. The US Department of Energy has just put forward a policy of “less supervision, more innovation” so as to expand US external energy supply capacity. In this field, the potential for China to expand imports from the United States and narrow the trade deficit is enormous.

The best way to deal with Trump’s threat of trade war is to clearly express the following points to the US side:

First, the only effective way to handle bilateral trade disputes is to negotiate on an equal basis and properly manage and control differences.

Secondly, as long as the US improves its own supply capacity, China will be able to greatly expand its imports from the United States.

Third, if the US government unilaterally launches a trade war, China will have no choice but to respond to the challenge whenever it comes. China may lose more in a trade war, but President Trump will see China has a higher capacity to bear losses than the United States.

If a trade war really happens, the issue is not who is laughing at the start but who is crying at the end. Based on my confidence in the Chinese system, I firmly believe that it won’t be China who will cry at the end.

Lyu Xiang, senior research fellow of Center for China and Globalization (CCG) and an expert on US studies with the Chinese Academy of Social Sciences

Opinion articles reflect the views of their authors, not necessarily those of China Focus

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +