United States-Provoked Trade War Set to Harm Entire Global Economy

The U.S. is trying to create an “America First” policy and realize so-called “American Supremacy” through the trade war, which is just a fantasy.

The trade war provoked by the United States has caused public indignation around the world. Most of the enterprises in various countries, and most international organizations, are criticizing the United States for launching this trade war. There are three reasons for such indignation.

Firstly, there is no legitimate basis for the U.S.-provoked trade war according to the international rules. The U.S. launched the trade war mainly on the basis of the Smoot-Hawley Tariff Act of 1930 and the Trade Act of 1974 which are domestic laws of the U.S. It is completely unreasonable and illegal for a country to impose sanctions on other countries in accordance with its own domestic laws and regulations. Obviously, the U.S. is holding high the “big stick of tariffs” — regardless of the international trade rules, and sidelining the international trade organizations including World Trade Organization and the United Nations Conference on Trade and Development — to sanction China and even its own allies (including Canada, Australia, Japan, Korea and others), which is violation of the international law, and the law of international trade.

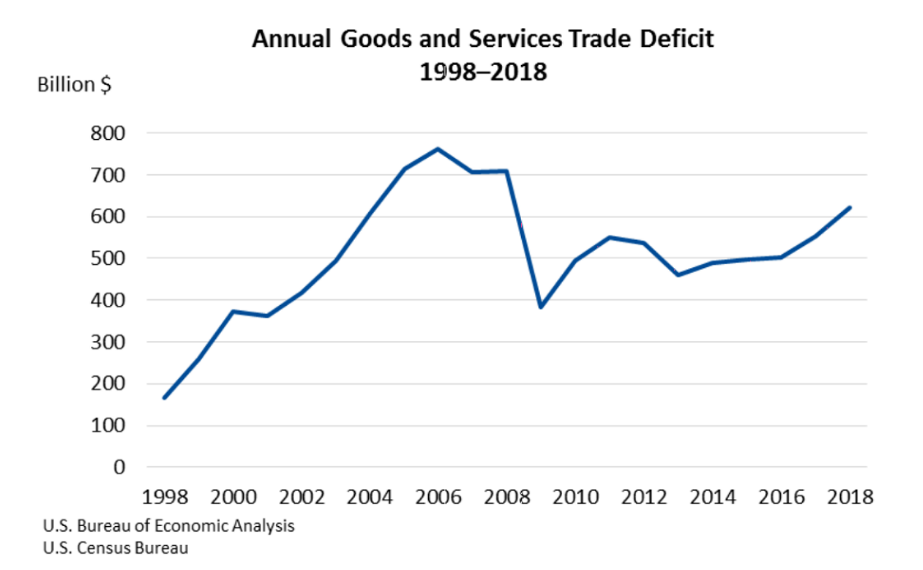

Secondly, the U.S. wants to solve the trade deficits issue, but violates the laws of economics and trade. The U.S. has trade deficits with 103 countries. The U.S. hopes to solve the problem of trade deficits, yet its policies achieve the opposite result. According to the U.S. Bureau of Economic Analysis and the U.S. Census Bureau, the U.S. international trade deficit (excluding the service trade) was $807.50 billion in 2017 and $891.32 billion in 2018.

Secondly, the U.S. wants to solve the trade deficits issue, but violates the laws of economics and trade. The U.S. has trade deficits with 103 countries. The U.S. hopes to solve the problem of trade deficits, yet its policies achieve the opposite result. According to the U.S. Bureau of Economic Analysis and the U.S. Census Bureau, the U.S. international trade deficit (excluding the service trade) was $807.50 billion in 2017 and $891.32 billion in 2018.

The results of the trade war launched by the U.S. against China, Japan, India, the EU and other countries and regions are the same. Trade deficits have increased rather than dropped. The US market requires imported goods from all over the world to satisfy its domestic needs. Therefore, the US is the source of the problem and should be held accountable for the consequences. The so-called sanctions imposed by the US on the results of trade based on market supply and demand are both ridiculous and in violation of the laws on international trade. With both sides suffering from sanctions, such policies stand to seriously influence the relationship between the US and its trade partners.

Thirdly, the negative influence of the US-provoked trade war will affect the global economy. According to the world investment report published by United Nations Conference on Trade and Development (UNCTAD) in 2018, direct foreign investment worldwide dropped by 23% in 2017 and 41% in the first half of 2018. Additionally, it has dropped by over 40% among developed countries in 2018.

Although foreign direct investment in China has increased 3% last year, the foreign investment growth rate dropped significantly. Global trade growth rate also dropped sharply in 2017 and 2018. And still, the deepening of the trade war brings even greater risks. The International Monetary Fund has lowered its global economic growth rate estimate for 2019 three times in a row from 3.9% to 3.7%, then to 3.5% and finally to 3.3%. This economic downturn has been completely caused by the uncertainty and risk the world economy faces as a result of the trade war launched by the U.S. Therefore, all countries, particularly those with established trade relations with the US, are scornful of and resolutely oppose the actions of the U.S. In fact, the U.S. is attempting to force the whole world, especially its trade partners, into a “united front”, leading to contradictions and disputes among such countries. As the troublemaker and spoiler of the normal trade order worldwide, the U.S. is bound to be opposed, sanctioned and condemned by the whole world.

Although foreign direct investment in China has increased 3% last year, the foreign investment growth rate dropped significantly. Global trade growth rate also dropped sharply in 2017 and 2018. And still, the deepening of the trade war brings even greater risks. The International Monetary Fund has lowered its global economic growth rate estimate for 2019 three times in a row from 3.9% to 3.7%, then to 3.5% and finally to 3.3%. This economic downturn has been completely caused by the uncertainty and risk the world economy faces as a result of the trade war launched by the U.S. Therefore, all countries, particularly those with established trade relations with the US, are scornful of and resolutely oppose the actions of the U.S. In fact, the U.S. is attempting to force the whole world, especially its trade partners, into a “united front”, leading to contradictions and disputes among such countries. As the troublemaker and spoiler of the normal trade order worldwide, the U.S. is bound to be opposed, sanctioned and condemned by the whole world.

In addition, the U.S. is trying to create an “America First” policy and realize so-called “American Supremacy” through the trade war, which is just a fantasy. The reasons why this is a fantasy are as follows.

Firstly, the global industrial chain, supply chain, service chain and value chain are closely linked, yet the U.S. is still using traditional methods to wage a modern trade war. As we all know, two-thirds of global trade are composed of intermediate products and investment products. When the US imposed additional tariffs on $50 billion of Chinese imports, 73% of the products covered were intermediate products and investment products. When the U.S. imposed additional tariffs on $200 billion of Chinese imports, 78% of the products covered were intermediate products and investment products.

Such a large proportion of intermediate products and investment products provide enterprises in the U.S. with the intermediate products required as part of their industrial chain, and also provide consumers in the U.S. with cheap, high-quality consumer goods. Meanwhile, importers in the U.S. earn profits from the circulation of such products. In terms of practical consequences, 90% of the tariffs added by the U.S. will be borne by importers, which will ultimately pass to U.S. enterprises, consumers and farmers, inevitably lowering social welfare of the U.S.

Such a large proportion of intermediate products and investment products provide enterprises in the U.S. with the intermediate products required as part of their industrial chain, and also provide consumers in the U.S. with cheap, high-quality consumer goods. Meanwhile, importers in the U.S. earn profits from the circulation of such products. In terms of practical consequences, 90% of the tariffs added by the U.S. will be borne by importers, which will ultimately pass to U.S. enterprises, consumers and farmers, inevitably lowering social welfare of the U.S.

In addition, tariffs will have greater impact on the U.S. than on China. Firstly, the new tariffs directly affect US exports’ access to the Chinese market. Second, many U.S. products are banned from export. The major market of many high-tech products and core parts is China. High technology and advanced products should enter the global industrial chain, as they are of no value without access to a market. Practices against the laws of economics will merely accelerate the decline of the U.S. and trigger social problems and deep-seated economic risks at a crucial time.

In addition, tariffs will have greater impact on the U.S. than on China. Firstly, the new tariffs directly affect US exports’ access to the Chinese market. Second, many U.S. products are banned from export. The major market of many high-tech products and core parts is China. High technology and advanced products should enter the global industrial chain, as they are of no value without access to a market. Practices against the laws of economics will merely accelerate the decline of the U.S. and trigger social problems and deep-seated economic risks at a crucial time.

Finally, dependence on foreign trade was as high as 60% in the early years of China’s reform and opening-up, before dropping to 50% a decade ago and standing at around 30% currently. China is experiencing industrial restructuring and the structural change of supply and demand in domestic and foreign markets. As a result, the resilience, space and flexibility of the economic development in China is sound. How can the U.S. high tariffs curb China’s development?

Chen Wenling, Chief Economist, China Center for International Economic Exchanges

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +