Further Opening of China’s Financial Sector Brings New Opportunities to the World

“Opening-up is key to China’s economic growth over the past 40 years, and high-quality development of China’s economy in the future can only be achieved with greater openness”, said Chinese President Xi Jinping at the recent Boao Forum for Asia (BFA) Annual Conference 2018.

By Bian Yongzu, Zhu Sihan

“Opening-up is key to China’s economic growth over the past 40 years, and high-quality development of China’s economy in the future can only be achieved with greater openness”, said Chinese President Xi Jinping at the recent Boao Forum for Asia (BFA) Annual Conference 2018.

At the session on “Monetary Policies: Back to Normal” during the Boao Forum for Asia Annual Conference 2018, Yi Gang, China’s central bank governor, fleshed out measures to further open up the financial sector, signaling rapid progress in implementing the country’s opening-up promises.

China’s Financial Sector Has Developed Rapidly over the Past 40 Years of Reform and Opening-up

With the fast growth of China’s economy, China’s financial sector has developed rapidly over the past forty years.

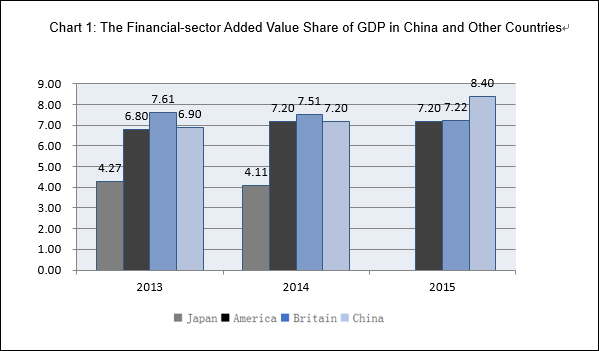

The share of added value in GDP from China’s financial sector has grown steadily from 4% in 2005 to 8.4% in 2015, more than doubled in only 10 years (see Chart 1), and the scale keeps expanding. This figure outperforms many other countries, including the US and the UK, two traditional financial powers (their financial-sector added value shares of GDP in 2015 are respectively 7.2% and 7.22%).

As China’s capital market becomes more vibrant and the stock transaction volume rises year by year, the Internet financial information service industry has a broader space for development. Since the financial sector plays an increasingly important role in the national economy, its rapid growth and its contribution to GDP will give momentum to the rapid development of the financial information service industry.

Problems Behind the Rapid Development of China’s Financial Sector

Behind the rapid development of China’s financial sector, there are urgent problems to be addressed.

For example, on-balance sheet items tend to be hidden off-balance, loan transactions are used for investing, banks take advantage of inter-bank transactions to make profits, and bank funding goes to lending or real estate rather than helping real businesses. Innovations such as bitcoin and other block chain products are deviating from their original purpose. Bitcoin and its related activity has become a speculative minefield with huge price volatility, which could lead to risks that cannot be ignored.

Second, the existing financial governance lags behind the fast technology advance and model diversification in internet financing, which in turn, has created significant risks in both financial sector and the economy at large.

Last but not least, our IPO (Initial Public Offering) system continues to manage public offerings and listings, though the inclusiveness and adaptability of the system are not well adapted to developing trends in the modern open economy. The expansion and opening of the financial sector will bring unprecedented challenges and new opportunities, and will play a vital role in vitalizing of the financial market.

The Significance of Expanding China’s Financial Opening up

Our past history shows that opening-up can not only make money, but more importantly, acquire others’ advanced management skills.

Learning from foreign countries is essential to China’s financial sector.

Therefore, Governor Yi Gang says that China will follow three principles in promoting financial sector opening-up. First, we will adopt pre-establishment national treatment and a negative list. Second, financial sector opening-up will go in tandem with the progress of exchange rate regime reform and capital account convertibility. Third, financial regulatory capacity should match the openness of the financial sector so as to prevent financial risks.

The following measures for opening up the financial sector will be implemented in the next few months this year:

In banking, remove the foreign ownership cap for banks and asset management companies, treating domestic and foreign capital equally; allow foreign banks to set up branches and subsidiaries at the same time.

This measure will encourage asset management transactions of Chinese capital banks to conform to international standards, and help to change the rigid payment system in the banking industry. Meanwhile, a large number of foreign investments coming into China will bring huge opportunities for China’s banking industry to learn professional skills and advanced technologies, and will increase the efficiency of China’s banking industry as well as improve legal supervision of domestic monetary authorities.

In the securities industry, the foreign ownership cap to 51% for securities companies, fund managers, futures companies, and life insurers, will be removed in three years.

Yi Gang’s explained that we are aiming to launch the Shanghai-London Connect this year. This deepens China-UK cooperation in finance, and also shows the world China’s strong intent and will to act in the two-way opening of the capital market.

From a macro perspective, the openness of financial sector can enhance competition among the entities operating in the financial market. Through this competition Chinese companies can acquire advanced financial ideas from foreign companies, so as to make China’s financial system more flexible.

In the long run, the inflow of foreign capital and the growth of domestic bond holdings will help our economy to resolve debt risks and to stabilize the bond market, creating a more stable financial environment.

From a micro perspective, China, as the third largest bond market in the world, still has a low ratio of foreign investor holding bonds, mainly with a single species. With the further opening of the bond market, China will learn from developed countries in the development of bond markets, innovate financial products, safeguard financial services, and gradually improve the structure of China’s capital market while increasing the proportion of foreign investors holding Chinese bonds. In addition, with the further opening of the bond market, China will optimize the allocation of national financial resources, expand the financing approaches of business entities, and enhance the stability of the financial system.

In recent years, the Chinese government has paid high attention to financial risk prevention and control. The ability of the financial sector in withstanding risks has increased with the development of China’s economy. The 19th CPC National Congress said that as the real economy is the foundation of finance, finance should start from the premise that it will serve the real economy, and strengthen its ability to do so. In cooperating with technology, finance should adhere to this essential requirement. Regulators are using big data and other new technologies to fully supervise the financial market.

While liberalizing access to foreign investment and the scope of business, we should strengthen supervision over enterprises, avoid risk contagion across markets and products, provide safe havens for international funds, ensure the safety of funds, and strengthen financial security.

On the whole, China’s economic growth remains stable, the industrial structure continues to be optimized, investment growth is tending to slow down and stabilize, the international balance of payments as a whole is balanced, and there are greater opportunities in the financial sector. There are vast opportunities for foreign investors to enter China’s financial market on a wider, bigger and deeper scale.

By Bian Yongzu, researcher of Chongyang Institute of Finance in Renmin University of China; Zhu Sihan, intern researcher of Chongyang Institute of Finance in Renmin University of China.

Editor: Cai Hairuo

Opinion articles reflect the views of their authors, not necessarily those of China Focus

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +