China’s Service Sector Becomes Major FDI Magnet

The FDI increase in China’s service sector is proof of its opening-up upgrading and deepening reform in its industrial structure.

China has maintained its top place as the most attractive destination for global investment by securing 1 trillion yuan ($156.85 billion) in the first 11 months of 2021, which is more than the entire 2020 FDI inflow. The investment further demonstrates the rising interest among global investors in the country’s service sector.

The foreign direct investment (FDI) in services has shown robust growth over the past 15 years, according to the latest reported data in the Chinese mainstream media. For example, services received a mere 24.7% of China’s total FDI in 2005, increasing to over 50% in 2011 and 77.7% in 2020. In the first 11 months of 2021, FDI in the service industry accounted for around 80% of total investment in the first 11 months of the year.

This trend is in part likely due to China’s huge service sector demands, particularly in the field of high-tech services and modern services, as well as the optimism held by service-oriented multinational entities.

There are various reasons for the shift in the interest of global entrepreneurs from the manufacturing to service industries, and one of the reasons lies in the fact that China’s economic priorities have shifted to its service sector.

China is still the global workshop when it comes to both small and large-scale manufacturing, and that growth ultimately results in a boom in various service sectors linked to manufacturing, such as legal, consulting, insurance, banking, and human resource industries.

After unhindered growth in development industries over the last four decades, China’s service sector is naturally poised for a boom. In the first 11 months of 2021, its high-tech services sector relating to manufacturing sub-sectors witnessed a 20% increase in FDI, affirming the fact that investors’ appetites are shifting from manufacturing to services.

Another reason for the increase in the share of service industries in FDI is due to their role in China’s net GDP. For example, the service industry contributed 50.5% to China’s GDP for the first time in 2015, highlighting its role in the years to come. When COVID-19 hit traditional sectors, services benefitted, and in the first three quarters of 2021, the sector contributed 54.2% to the overall growth of the country.

Investors’ change in attitude has also been necessitated by the importance of research and development (R&D), which is closely linked with the manufacturing sector. Most big businesses need cutting-edge technologies and development models to spearhead their growth.

Investors already in China or even those planning to invest in manufacturing need allied R&D services to compete in the market. Reportedly, U.S. giant Dow has already set up a research and development center in Shanghai ahead of its planned $250 million investment in the manufacturing hubs of Zhejiang and Guangdong provinces.

The paradigm shift in FDI has been witnessed in almost all developed nations, which first epitomized their growth through manufacturing and then slowly shifted to the service sector.

China is progressing through this transformation faster than most, which has been the hallmark of its overall development over the decades. The shift began after its adoption of the reform and opening-up policy in 1978, which has been wisely calibrated to suit its development ever since.

As promised on various occasions, China has continued the opening-up of its financial services sub-sector by removing restrictions on FDI caps on securities, fund management, future capital, and life insurance companies in 2020. It is further widening access to the service sector via pilot free trade zones.

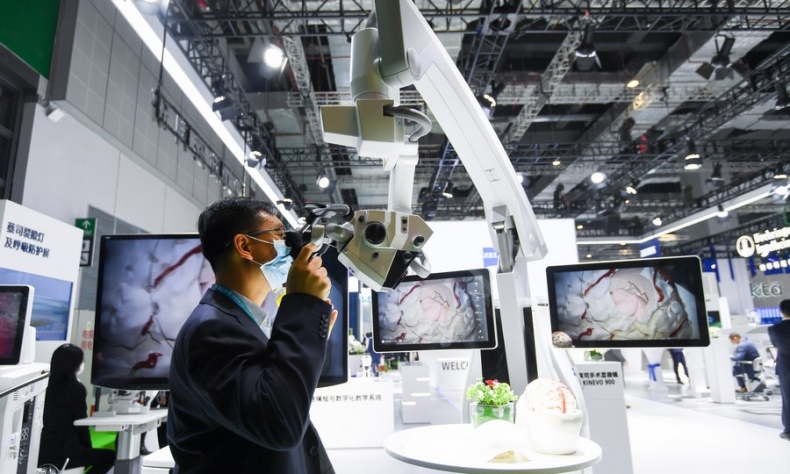

The FDI increase in China’s service sector is proof of its opening-up upgrading and deepening reform in its industrial structure. Fast-track growth of the service sector in China, ranging from modern finance and intelligent logistics to the digital economy, and medical treatment and old-age care, now offers more opportunities for foreign companies to tap the country’s market potential in a more open business environment.

Sajjad Malik is a columnist with China.org.cn.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +