Review: Cracking the China Conundrum by Yukon Huang

Cracking the China Conundrum methodically tackles all of the prominent doubts about the Chinese economy with convincing and logical counterarguments.

By Andrew Spivey

Although facing constant scrutiny, and despite having an economy so deeply integrated with the world economy that it serves as the top trading partner for over 120 countries, there still persists among foreign observers a severe lack of understanding of China’s economic model and China’s role in the international economy. With repeated predictions of an imminent crash of the Chinese economy due to insurmountable debt, the inability of western analysts to correctly comprehend the Chinese model and its prospects is even more concerning. Such misguided analysis will inevitably generate inaccurate interpretations of the Chinese economy, as recently witnessed in nonsensical claims that China would henceforth be purchasing fewer U.S. Treasury Bonds, and will ultimately produce flawed policy responses. Fortunately Yukon Huang, in his universally praised 2017 book Cracking the China Conundrum, manages to provide some much needed clarity on the subject.

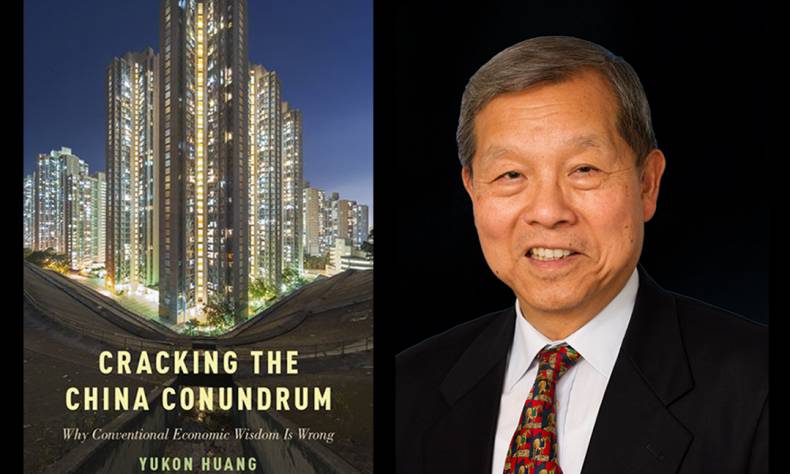

Yukon Huang and His New Book Cracking the China Conundrum

Yukon Huang and His New Book Cracking the China Conundrum

Yukon’s extensive experience, notably his role as the World Bank’s China Director from 1997-2004, makes him an authoritative voice on the Chinese economic model. The resulting respect he commands is evidenced by that fact that his articles frequently appear in numerous high-profile media outlets, including the Wall Street Journal, Bloomberg, The Financial Times and Foreign Affairs, by his role as an advisor to various other government bodies and international institutions, such as the Asia Development Bank and the Asian Infrastructure Investment Bank, and by his position as a Senior Associate at the Carnegie Asia Program. The diversity of sources that cite Yukon, including various western media who often harbour contentious views towards China, provide the credence to Yukon’s assessment that will persuade those perhaps sceptical of his work.

Cracking the China Conundrum methodically tackles all of the prominent doubts about the Chinese economy with convincing and logical counterarguments. Concerning the angst over China’s high debt levels causing a financial crash, Yukon points out that as a share of GDP China’s debt is actually at an average for major economies, and that the majority of the debt is both public and sourced domestically (with comparatively more lenient collection terms than those of private foreign lenders), and thus the outlook is sounder than alarmists would claim.

Issues Facing the Chinese Economy

Of the legitimate issues facing the Chinese economy, Yukon also helps ascertain exactly what they are, and how to amend them. For example, he shows that the excessive lending by the state-owned banking system was actually in response to pressure from local governments, who lacked the authority to raise the required revenue to finance the infrastructure and social services underpinning their rapidly growing economies. Thus, Yukon exposes that it is a consequence of a weak fiscal system that forced local governments to rely on the state-owned banks to fund these essential projects and services. By knowing the true cause of the banks high lending levels, not only can fears of a financial crisis be alleviated, but a deeper understanding of the unique characteristics of the Chinese economic model can be attained.

Chinese Model is Different and Non-Comparable

Yukon gives further insights into how the Chinese model is so vastly different, and non-comparable, to the western model. Through this method investment is encouraged in infrastructure and industrial expansion, helping to drive growth, whilst the state still maintains ultimate control over the major resources, ensuring they serve the greater strategy for Chinese economic development. Only someone with such an intricate knowledge of China’s economic model as Yukon can so aptly explain to the readers why commonly held judgments about China’s economy are so unfounded.

Why Have the Misconceptions Arisen?

Yukon presents his analysis in an impartial manner, and always strives to identify and reason why such misconceptions have arisen. With China’s rise re-configuring the world’s geopolitical balance, and the visible success of the Chinese model undermining the previously-held belief in the universal nature of western market-led capitalism and the democratic model, many western perspectives are undoubtedly clouded by anxieties over China’s challenge to western dominance, and also by differences in ideology. The above factor is well understood, but can also only be applied to select cases. Reflecting the well-rounded nature of Yukon’s analysis, he highlights other, often overlooked, reasons for erroneous judgements. For one, the vast scale and regional diversity of China results in different models being applied in the different regions – take for example the contrast between the Chongqing and the Guangdong models. With such disparity, general conclusions are inevitably going to be risky. Furthermore, Yukon highlights the lack of an agreed upon and appropriate framework for analyzing the Chinese economy, with current methods too western-centric and not appreciative of China’s unique characteristics. Take for example the current academic understanding of the forces of market competition. From a western perspective competition is driven among firms in a free and open market. Yet, unique to China, the local government entities also form part of the competitive economic environment. Without incorporating factors such as this, Yukon warns, misunderstandings are inevitable.

For those bellicose over the U.S.-China economic relationship, Yukon again provides refreshing clarity to correct widely held misconceptions. Regarding western misgivings about China’s “unbalanced” growth (a disproportionately low share of personal consumption and high level of outward investment), Yukon elaborates on why “unbalanced” growth is actually a necessary consequence of a successful long-term development process. As workers migrate from labor-intensive rural activities to more capital-intensive industrial jobs in cities (where the cost of the new components in the factory far exceed the increases in consumption of the newly migrated worker) there is a corresponding decline of consumption and increase in investment as a proportion of GDP. Similarly, Yukon succeeds in deconstructing the controversial topic of the huge U.S. trade deficit with China, delivering the salient point, which has the potential to defuse U.S.-China trade relations, that ultimately America’s trade deficit is a consequence of both the American government and the American public spending beyond their means. The fact that China is the major source of the offsetting trade surplus is somewhat irrelevant – when the United States gets its finances back in order, the trade deficit will correspondingly recede.

The World Benefits From a Stable and Prospering China

In addition to diagnosing the flashpoints in the U.S.-China relationship, Yukon also prescribes several policy suggestions. In his view it is not just China, but the world as a whole that benefits from a stable and prospering China, an outlook reflected in his policy proposals. For example, he argues the debate over U.S.-China trade should reorient away from punitive tariffs and instead focus efforts on enacting a new bi-lateral treaty to liberalize access to each other’s markets, spurring competition and knowledge exchange. By exposing fallacies in conventional readings of China, Yukon hopes to both show the world the merits of the Chinese model, and also prove that economic differences are not destined to be zero-sum game, but should be perceived as opportunities for win-win cooperation. Hence throughout the book Yukon provides for readers both clarity on the true nature of the “China Conundrum”, and also reassurance that engagement with China is the correct response.

Not only is Yukon’s book thoroughly researched and laden with facts, but he possesses the rare ability to effectively combine high-level economic analysis with a smooth and clear writing style, that ultimately enables him to convey his comprehensive explanation of the Chinese model coherently and persuasively with relative ease. By discrediting the commonly held misconceptions about the Chinese economic system and contributing fresh contrarian interpretations, Yukon manages to substantiate the claim made in the book’s subtitle why conventional economic wisdom is wrong. Cracking the China Conundrum is essential reading for anyone seeking to fully understand the Chinese economic model, how the Chinese economy developed to where it is now, and what its prospects are for the future.

Andrew Spivey is cnmatters’ columnist, and the article reflects the author’s opinion, and not necessarily the view of China Matters.

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +

The People’s Bank of China

The People’s Bank of China Chongqing Municipality

Chongqing Municipality